SAAS Tools for Investor Empowerment, Listed Asset Search, Portfolio Construction & Review

SAAS Tools for Investor Empowerment, Listed Asset Search, Portfolio Construction & Review

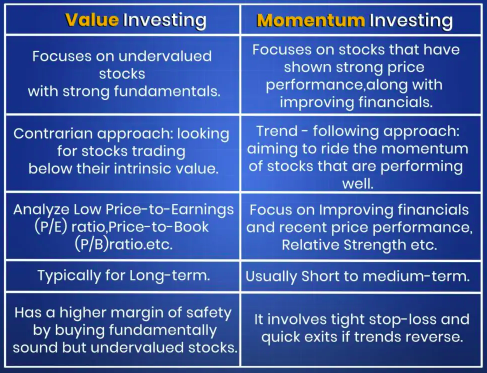

When it comes to growing wealth through the markets, investors are often caught between two schools of thought: fundamentals-based investing and momentum investing. Both approaches have loyal followers, decades of data, and moments of glory. But which one truly holds up over the long term?

Let’s unpack the core of each strategy and look at what the evidence says.

This approach focuses on the intrinsic value of a company. Investors analyze financials, growth potential, and competitive advantages to determine whether a stock is under- or over-valued. It’s the philosophy behind value investing, popularized by Warren Buffett and Benjamin Graham.

Key Traits:Momentum investing centers around price trends. The belief is that assets that are rising will continue to rise (and vice versa). It relies more on market psychology and price signals than financials.

Key Traits:Fundamental investors believe in rational analysis and long-term value. Momentum investors capitalize on short-term market behavior driven by emotion and trends.

It's not a simple winner-takes-all. Momentum strategies can outperform over 3–12 month windows, especially in bull markets. But fundamentals-based strategies tend to shine in the long run, especially through market downturns, thanks to underlying business strength.

It depends on your goals and temperament:

Some strategies now blend both — screening for strong fundamentals, then applying momentum filters for timing.

There’s no single “best” strategy — but if your goal is sustainable wealth, fundamentals-based investing has a proven track record. It may not be flashy, but it’s grounded in real business performance. Momentum has its moments but often demands tighter risk management and timing.

FinSight Investment Assistant allows investors to blend fundamental and momentum strategies and monitor the success of decisions and forecasts through time.

Want to explore how a fundamentals-first approach can help you build a resilient investment portfolio? Try FinSight Investment Assistant — designed to bring clarity and confidence to your investment journey.