SAAS Tools for Investor Empowerment, Listed Asset Search, Portfolio Construction & Review

SAAS Tools for Investor Empowerment, Listed Asset Search, Portfolio Construction & Review

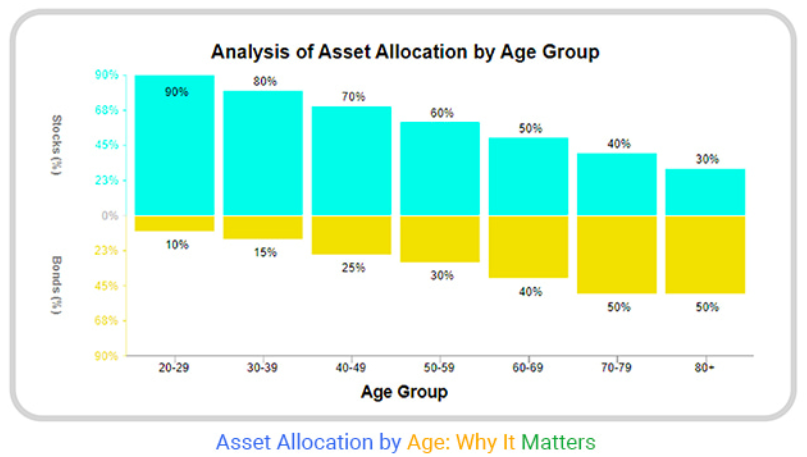

When it comes to building and preserving wealth, how you allocate your investments across asset classes — like stocks, bonds, and cash — matters as much as the specific investments you choose. This mix, known as your asset allocation, isn’t fixed. It should evolve with your age, goals, and risk tolerance.

In this guide, we’ll explore what asset allocation means, why it’s essential, and how it typically shifts through different life stages.

Asset allocation is the strategy of dividing your portfolio among major investment categories, such as:

Research shows that asset allocation accounts for over 90% of long-term portfolio returns — more than stock picking or market timing. A well-planned allocation can help you grow wealth in your prime years and protect it as you approach retirement.

Suggested allocation: 80–90% stocks, 10–20% bonds/alternatives

At this stage, time is your biggest asset. You can afford to take more risk to pursue higher returns.

Suggested allocation: 70–80% stocks, 20–30% bonds/fixed income

As your responsibilities increase, consider slightly reducing risk while still maintaining a growth focus.

Suggested allocation: 60–70% stocks, 30–40% bonds

Retirement is approaching. Start shifting your portfolio to reduce volatility and protect gains.

Suggested allocation: 40–50% stocks, 50–60% bonds or cash

Now it’s about preserving capital and ensuring steady income through retirement years.

Your portfolio will drift over time due to market performance. Rebalancing once or twice a year helps maintain your desired asset mix and risk level.

Your asset allocation should reflect where you are in life. As you age, shift toward a balance that protects your capital while still allowing for moderate growth. There’s no one-size-fits-all, but being intentional with your allocation is key to long-term financial success.

Want to know how to get the best out of your listed asset allocation? Use FinSight Investment Assistant to ensure the best performance and monitoring for your listed asset allocation.